A Core Alternative

Solution

BXMIX provides a diversified blend

of alternative strategies and hedge fund managers

in a single daily liquid mutual fund.1

We harness the power of BXMA’s scale, manager

relationships and investment expertise to democratize access to differentiated exposures.

Reasons to Invest

In pursuing its investment objective of capital appreciation,

Blackstone Alternative Multi-Strategy Fund seeks to deliver1:

Diversification

Invests in a variety of alternative strategies in an effort to provide diversified exposures that are less dependent on market movements.1

Risk-Adjusted Returns

Seeks to deliver steady growth with a focus on maximizing risk-adjusted returns over a full market cycle.

Why BXMIX at Blackstone?

Blackstone Multi-Asset Investing (BXMA) has partnered

with some of the world’s leading investors since 1995.

Partnership

Deep, differentiated relationships with hedge fund talent

People

Large investment team with experience across all of the key investment strategies

Position

Our scale and breadth of relationships, coupled with Blackstone’s global reach, allow us to better identify, evaluate and implement new investments

Process

Disciplined investment and operational due diligence; proprietary risk management and technology

Check the background of this firm on FINRA’s BrokerCheck.

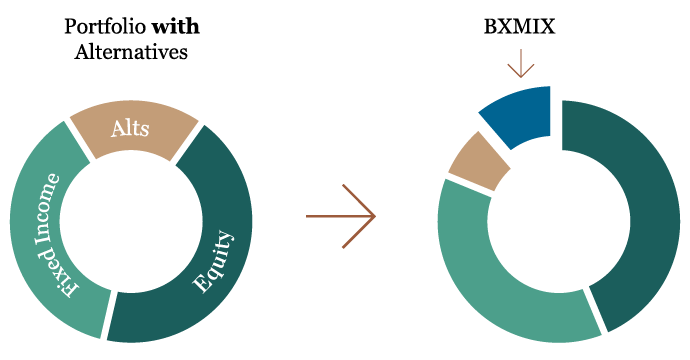

Why Multi-Manager

Aims to ease the burden on financial advisors and investors of

evaluating and allocating to multiple single-strategy funds

Diversification

Diversification is critical in investing and helps reduce risk in a portfolio. The Fund’s multi-manager structure provides built-in diversification for investors who seek to avoid single manager risk.1

Access to Specialists

Specialists with expertise in specific alternative strategies are combined in one solution. Given the complexity of many of these strategies, it is unlikely that a single manager has expertise across all of them.

Dynamic Allocation

Dynamic allocation allows Blackstone to rotate into more attractive sectors, strategies and managers as markets evolve.

Data as of January 2024.

Key Differentiators

Seeking to capitalize on competitive advantages in scale,

structuring, and strategy rotation to benefit investors

Scale

- Deep insights from our position within Blackstone provides an edge5

- Global investment team with experience across asset classes, strategies, and investment styles

- Dedicated access to strategies with scarce capacity

Structuring

- Tailored mandates democratize access to specific skills and exposures

- Innovative open-architecture framework accommodates a wide array of strategies

- Separate accounts increase portfolio efficiency and transparency

Strategy Rotation

- Allocations informed by proprietary insights from the Blackstone ecosystem5

- Multi-strategy, multi-manager construct allows dynamic shifts in positioning

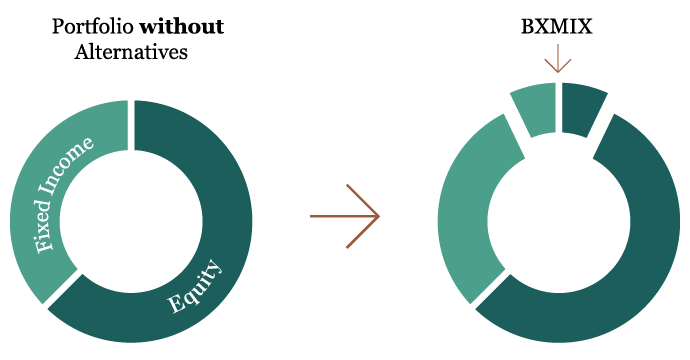

Asset Allocation

A natural complement to a traditional allocation.

Portfolio Managers

Blackstone seeks to add value through top-down strategy

selection and bottom-up manager evaluation.

Literature and Multimedia Content

Fact Card

BXMIX Quarterly Commentary | Q4 2023

BXMIX Sub-Adviser Profiles

BXMIX Update | 2023 Year in Review

Fund Documents and Public Filings

Investor Material

Summary Prospectus | |

Prospectus | |

Statement of Additional Information | |

Annual Report | |

Semi-Annual Report | |

Portfolio Holdings | |

Annual Proxy Voting Report | |

SEC Filings | |

Information Statements | |

2023 Year-End Distribution | |

2022 Year-End Distribution | |

Form 5500 |

- There can be no assurance that the Fund will achieve its goals or avoid losses. Diversification does not ensure a profit or guarantee against loss.

- Blackstone and its affiliates have financial interests in asset managers. Any allocation by Blackstone to a subsidiary or other affiliate benefits Blackstone Inc. and any redemption or reduction of such allocation would be detrimental to Blackstone Inc., creating potential conflicts of interest in allocation decisions. For a discussion of this and other conflicts, please see the Important Risks section at the end of this page.

- BAIA manages a portion of the Fund’s assets directly. Such investments presently include allocations to funds managed by third-party asset managers, opportunistic trades and hedging. BAIA allocations are subject to change and BAIA’s fees on directly managed assets are not reduced by a payment to a sub‐adviser.

- Inactive sub-advisers are not currently managing any Fund assets. Allocations may change at any time without notice.

- Subject to Blackstone’s information walls and confidentiality and fiduciary obligations.

Important Information

This material is not an offer to sell the Fund’s securities and is not soliciting an offer to buy the Fund’s securities. All investors should consider the investment objectives, risks, charges and expenses of BXMIX, Class I carefully before investing. All investors are urged to carefully read the prospectus and the summary prospectus in its entirety before investing. The prospectus and the summary prospectus contain this and other information about BXMIX and are available on BXMIX’s website at www.bxmix.com.

Please note that additional details concerning the Fund’s performance, liquidity and asset class exposures are available upon request. Please contact your BXMA representative for further information.

No Assurance of Investment Return. Performance data quoted represents past performance and is no guarantee of future results. Investment returns and principal values may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. All returns include dividend and capital gain distributions. There can be no assurance that the Fund will achieve its goals or avoid losses. Diversification does not ensure a profit or guarantee against loss. Information about the Fund, including current month-end performance, is available on the Fund’s website at www.bxmix.com or by calling 855-890-7725.

Allocations: The Fund may shift allocations among sub-advisers, strategies and sub-strategies at any time. Further, Blackstone, on behalf of the Fund, may determine to not employ one or more of the above-referenced, strategies or sub- strategies. Blackstone may also add new strategies or sub-strategies. Accordingly, the allocations are presented for illustrative purposes only and should not be viewed as predictive of the ongoing composition of the Fund’s portfolio (and its sub-advisers),which may change at any time without notice.

ERISA Fiduciary Disclosure: The foregoing information has not been provided in a fiduciary capacity under ERISA, and it is not intended to be, and should not be considered as, impartial investment advice. If you are an individual retirement investor, contact your financial advisor or other fiduciary unrelated to BAIA about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances.

Opinions and Trends. Opinions expressed reflect the current opinions of Blackstone as of the date appearing in the Materials only and are based on Blackstone’s opinions of the current market environment, which are subject to change. Certain information contained in the Materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Important Risks

An investment in the Fund should be considered a speculative investment that entails substantial risks; you may lose part or all of your investment or your investment may not perform as well as other investments. The Fund’s investments involve special risks including, but not limited to, loss of all or a significant portion of the investment due to leveraging, short-selling, or other speculative practices, lack of liquidity and volatility of returns. The following is a summary description of certain additional principal risks of investing in the Fund:

Allocation Risk – Blackstone’s judgment about the attractiveness, value or market trends affecting a particular asset class, investment style, sub-adviser or security may be incorrect and this may have a negative impact upon performance. Market Risk and Selection Risk – One or more markets may go down in value, possibly sharply and unpredictably, affecting the values of individual securities held by the Fund. Derivatives Risk – the use of derivatives involves the risk that their value may not move as expected relative to the value of the relevant underlying assets, rates, or indices. Derivatives can be subject to counterparty credit risk and may entail investment exposure greater than their notional amount. Debt Securities Risk – investments in bonds and certain asset-backed securities are subject to risks, including but not limit to, the credit risk of the issuer of the security, the risk that the issuer undergoes a restructuring or a similar event, the risk that inflation decreases the value of assets or income from the investments, and the risk that interest rates changes adversely impact the debt investments. Equity Securities Risk – prices of equity and preferred securities fluctuate based on changes in a company’s financial condition and overall market and economic conditions. Mortgage- and Asset-Backed Securities Risk – involves credit, interest rate, prepayment and extension risk, as well as the risk of default of the underlying mortgage or asset, particularly during times of economic downturn. Multi-Manager Risk– managers may make investment decisions which conflict with each other and as a result, the Fund could incur transaction costs without accomplishing any net investment result. Leverage Risk – use of leverage can produce volatility and may exaggerate changes in the net asset value of Fund shares and in the return on the portfolio, which may increase the risk that the Fund will lose more than it has invested. Large Purchase or Redemption Risk – large redemption or purchase activity could have adverse effects on performance to the extent that the Fund incurs additional costs or is required to sell securities, invest cash, or hold a relatively large amount of cash at times when it would not otherwise do so.

Recent Market Events Risk. Local, regional, or global events such as war (e.g., Russia/Ukraine), acts of terrorism, public health issues like pandemics or epidemics (e.g., COVID-19), recessions, or other economic, political and global macro factors and events could lead to a substantial economic downturn or recession in the U.S. and global economies and have a significant impact on the Fund and its investments. The recovery from any downturns is uncertain and may last for an extended period of time or result in significant volatility, and many of the risks discussed herein associated with an investment in the Fund may be increased.

Conflicts of Interest: Blackstone and the Sub-Advisers have conflicts of interest that could interfere with their management of the Fund. These conflicts, which are disclosed in the Fund’s Statement of Additional Information, include, without limitation:

- Selection of Sub-Advisers. Blackstone compensates the Sub-Advisers out of the management fee it receives from the Fund. This could create an incentive for Blackstone to select Sub-Advisers with lower fee rates.

- Financial Interests in Sub‐Advisers and Service Providers. Blackstone, the Sub‐Advisers, and their affiliates have financial interests in asset managers and financial service providers. Allocating to an affiliate (or hiring such entity as a service provider) benefits Blackstone Inc. and the relevant Sub‐Adviser and redemptions from an affiliate (or terminating such entity as a service provider) would be detrimental to Blackstone Inc. and the relevant Sub‐Adviser. For example:

- Blackstone Strategic Alliance Advisors L.L.C. (“BSAA”), an affiliate of BAIA, manages the Strategic Alliance Funds (the “SAF Funds”) that provide seed capital to emerging alternative asset managers (the “SAF Managers”) in exchange for a revenue share arrangement. Seiga Asset Management Limited, a SAF Manager, is a sub‐adviser to the Fund. The revenue generated for BSAA related to the Fund’s investment with a SAF Manager is rebated to the Fund. The Fund will not otherwise participate in any of the economic arrangements between the SAF Funds and any SAF Manager with which the Fund invests.

- Blackstone Strategic Capital Advisors L.L.C. (“BSCA”), an affiliate of BAIA, manages certain funds (the “BSCA Funds”) that acquire equity interests in established alternative asset managers (the “Strategic Capital Managers”). One of the Strategic Capital Managers in which the BSCA Funds have a minority interest is Magnetar Capital Partners L.P., a control affiliate of Magnetar Asset Management LLC, a sub‐adviser for the Fund. The revenue generated for BSCA related to the Fund’s investment with a Strategic Capital Manager is rebated to the Fund. The Fund will not participate in any of the economic arrangements between the BSCA Funds and any Strategic Capital Manager with which the Fund invests.

- Blackstone Real Estate Special Situations Advisors L.L.C. (“BRESSA”), an affiliate of BAIA and an indirect wholly-owned subsidiary of Blackstone Inc., serves as a Sub-Advisor Sub-Adviser. BRESSA invests primarily in liquid, commercial and residential real estate-related debt instruments.

- Blackstone Liquid Credit Strategies LLC (“BX LCS”), an affiliate of BAIA and an indirect wholly‐owned subsidiary of Blackstone Inc., serves as a Sub‐Adviser. BX LCS invests primarily in below investment grade corporate credit.

- Blackstone utilizes technology offered by Arcesium LLC (“Arcesium”) to provide certain middle‐ and back‐office services and technology to the Fund. The parent company of a Sub‐Adviser owns a controlling, majority interest in Arcesium and Blackstone Alternative Asset Management L.P. owns a non‐controlling, minority interest in Arcesium.

- Other Activities of Blackstone or the Sub-Advisers. The activities in which Blackstone, the Sub-Advisers, or their affiliates are involved in on behalf of other accounts may create conflicts of interest or limit the flexibility that the Fund may otherwise have to participate in certain investments. For example, if Blackstone or a Sub-Adviser comes into possession of material non-public information with respect to a company, then Blackstone or the relevant Sub-Adviser generally will be restricted from investing in securities issued by that company. Further, Blackstone generally will be restricted from investing in portfolio companies of its affiliated private equity business.

- Allocation of Investment Opportunities. Blackstone and the Sub-Advisers (or their affiliates) manage other accounts and have other clients with investment objectives and strategies that are similar to, or overlap with, the investment objective and strategy of the fund, creating potential conflicts of interest in investment and allocation decisions. These conflicts of interest are exacerbated to the extent that the other clients are proprietary or pay higher fees or performance-based fees.

Glossary of Terms: Gross Exposure: Reflects the aggregate of long and short investment positions in relation to the net asset value. The gross exposure is one indication of the level of leverage in a portfolio. Net Exposure: This is the difference between long and short investment positions in relation to the net asset value. Long Exposure: A long position occurs when an individual owns securities. Short Exposure: Short selling a security not actually owned at the time of sale. Short positions can also generate returns when the price of a security declines. Beta: A measure of the volatility, or systemic risk, of a security or a portfolio in comparison to the market as a whole. Alpha: A risk-adjusted performance measure that represents the average return on a portfolio over and above that predicted by the capital asset pricing model (CAPM), given the portfolio’s beta and the average market return. More specifically, Jensen’s Measure is used to calculate alpha. Standard Deviation: A measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is calculated as the square root of variance.

Index Comparisons: Indices are unmanaged and investors cannot invest in an index. Indices are provided for illustrative purposes only. They have not been selected to represent appropriate benchmarks for BXMIX, but rather are disclosed to allow for comparison of BXMIX’s performance to that of well-known and widely recognized indices. The indices may include holdings that are substantially different than investments held by BXMIX and do not reflect the strategy of the Fund. Comparisons to indices have limitations because indices have risk profiles, volatility, asset composition and other material characteristics that may differ from BXMIX. The indices do not reflect the deduction of fees or expenses. In the case of equity indices, performance of the indices reflects the reinvestment of dividends. Index data is obtained from unaffiliated third parties and is subject to subsequent adjustments. Blackstone makes no assurances as to the accuracy or completeness thereof.

Glossary of Indices: Market indices obtained through Bloomberg, HFR Asset Management, MSCI and Morngingstar, as applicable. MSCIWorld Index TR: Market capitalization weighted index designed to provide a broad measure of large and mid-cap equity performance across 23 developed markets countries. HFRX Global Hedge Fund Index: Designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies falling within four principal strategies: equity hedge, event driven, macro/CTA, and relative value arbitrage. Strategies are asset weighted based on the distribution of assets in the hedge fund industry. Barclays Global Aggregate Bond Index TR: Flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. Barclays US Aggregate Bond Index: A broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Morningstar Multistrategy Category: Represents the average performance of mutual funds categorized as “multistrategy” funds by Morningstar, Inc. These funds allocate capital (at least 30% combined) to a mix of alternative strategies that aim to minimize exposure to traditional market risks. S&P 500 Index: Market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. The S&P is a float-weighted index, meaning company market capitalizations are adjusted by the number of shares available for public trading.

None of the indices presented are benchmarks or targets for the Fund. Indices are unmanaged and investors cannot invest in an index.

Blackstone Securities Partners L.P. (“BSP”) is a broker-dealer whose purpose is to distribute Blackstone managed or affiliated products. BSP provides services to its Blackstone affiliates, not to investors in its funds, strategies or other products. BSP does not make any recommendation regarding, and will not monitor, any investment. As such, when BSP presents an investment strategy or product to an investor, BSP does not collect the information necessary to determine –and BSP does not engage in a determination regarding –whether an investment in the strategy or product is in the best interests of, or is suitable for, the investor. You should exercise your own judgment and/or consult with a professional advisor to determine whether it is advisable for you to invest in any Blackstone strategy or product. Please note that BSP may not provide the kinds of financial services that you might expect from another financial intermediary, such as overseeing any brokerage or similar account. For financial advice relating to an investment in any Blackstone strategy or product, contact your own professional advisor.